The state of women's sports: An investor's perspective.

Your weekly roundup of the latest, most interesting developments in sports investment.

The Sport Investment Studio is an investment and advisory platform dedicated to transactions at the intersection of Sport, Media and Entertainment based in Paris. Visit us for more information www.sportinvestmentstudio.com

Welcome to another edition of our newsletter on sports investment. This week, we talk about the state of women’s sport from an investor’s perspective.

I hope this newsletter gives you some useful background, insights and ideas on sports investments trends that we identify and focus on.

Don't hesitate to reach out to us for more, or to share your comments

What’s going on in women’s sport?

Over the past year, we’ve seen some eyebrow raising investments and valuations in women’s sport, such as:

A $450 million valuation for the WNBA’s New York Liberty, which came as a result of an unidentified group of investors acquiring 20% in the team.

The sale of NWSL side Angel City FC to Disney CEO Bob Iger and journalist Willow Bay for $250 million, just four years after the club was formed. In June 2025, nine months after the sale, the team was valued at $280m.

A $275 million valuation for the NWSL’s Kansas City Current, as reported by Forbes in June 2025. The team is co-owned by former footballer Brittany Mahomes, who is also the wife of NFL superstar Patrick Mahomes.

A $265 million valuation for Chelsea FC Women, following Alexis Ohanian’s purchase of a 10 percent stake in May 2025. Ohanian is a serial investor in women’s sport, having co-founded Angel City FC, as well as Athos, a women’s only athletics event.

These numbers have been supplemented and driven by rising interest in spectator interest and media rights values, as evidenced by:

New, record breaking broadcast deals for the WNBA ($200 million per year), NWSL ($60 million per year, a 40x increase) and the WSL in England (~£13 million per year), all signed over the past year.

Average attendance records being set across these leagues (48% increase in the WNBA, 14.1% for the NWSL and 41% for the WSL). Similar trends were seen in football around Europe (24% growth YoY), and also in sports such as cricket and rugby in markets like Australia and India.

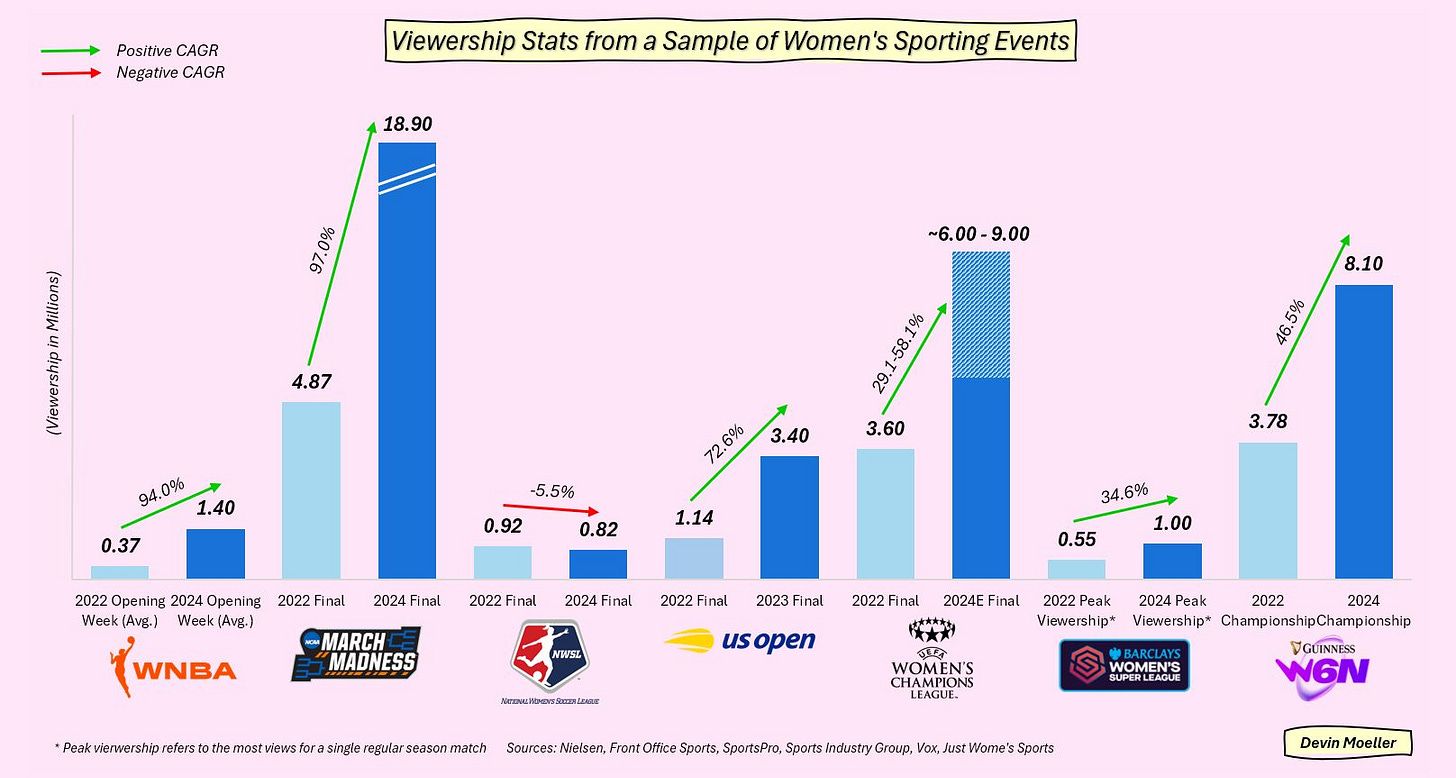

Record TV viewership, with over 44 million people watching women’s football in the UK, and over 54 million tuning into the WNBA in 2024.

North America is leading the charge.

This is not an overnight success. Decades of investment in girls’ and collegiate athletics created a deep talent-pipeline and a built-in fan base. Then, the closed, franchise-style economics of U.S. leagues bundled those athletes into scarce assets that national broadcasters could buy in a single rights package, letting revenues scale quickly.

Europe on the other hand, lags behind. Its women’s teams grew as add-ons to century-old men’s clubs rather than as stand-alone franchises, so their finances, governance and media rights remain bundled inside larger entities. Grassroots investment has also been lacking, and the absence of an American style collegiate sports system prevents talent from developing as well as it should. Add limited stadium access, slower moves toward salary floors, and a cultural lag in recognising women’s sport as a commercial product, and Europe’s growth curve looks sluggish.

There is also a disparity between sports when it comes to the women’s game. Sports like pickleball, athletics and tennis are already promising equal pay for male and female competitors. Due to a long history of competition, and given the pedigree of tournaments (French Open, US Open, etc.) here, these sports are better suited for scaling up women’s sport. This is driving investor interest: in 2023, CVC invested $150m in the WTA. In teams sports like football and rugby, the competitive scale is still imbalanced and relatively small; these sports also often see women’s teams as a mere extension of the men’s game.

In women’s sport, barriers to entry persist, and there is a great disparity between leagues and geographies. The typical club in the NWSL makes around $20m a year, and the number isn’t around the same in the WNBA. The European team with the highest revenue (FC Barcelona at $19 million), makes less than half of the top revenue generating side in the NWSL.

What can we conclude?

We can look to certain trends and KPIs in women’s sport, and let them guide our conclusions on the future of women’s sport as an investable proposition.

First, it is important to create original brands. For too long, women’s teams in Europe have been appendages of men’s teams, which has stifled growth. Now, the likes of Michelle Kang (through her investments in OL Lyonnes and London City Lionesses), as well as Mercury/13 (a consortium that has pledged $100 million to buy and scale women’s clubs) are looking to change this. Kang paid €50 million deal for a 52.9 % stake in OL Féminin (now OL Lyonnes) in February 2024, while Mercury/13 purchased Serie A side FC Como Women in the same year. By creating stand-alone women’s football brands, these investors aim to push club multiples toward the 8-10× revenue levels already seen for top U.S. franchises.

New formats for traditional sports (like Kings League/Baller League) are also disrupting the industry, with both having raised over $20m so far. Kings League now has a women’s tournament called Queens League, and as we discussed earlier, emerging sports like pickleball are leading the way when it comes to pay parity. Alongside the major leagues and teams, investors should keep an eye on these properties too as they plot their investments.

Finally, it is important for teams and properties to invest accordingly in their social media and commercial presence. Despite being successful on the pitch, clubs like Wolfsburg (170k followers on Instagram) and Manchester United (1.1m followers on Instagram) lag behind Chelsea, Arsenal and FC Barcelona in revenues and following, largely due to how the latter set of teams have commercialised themselves. Arsenal for example, reported a 48% increase in commercial revenues YoY in 2024, and played a total of 11 games at the Emirates Stadium (6 in the previous year). Such a proactive approach is necessary if professional teams are to become investable propositions in Europe.

📰 Read more:

The Athletic’s report on rising valuations in women’s sport. (The Athletic)

Deloitte’s primer on the state of women’s sport as of 2024, replete with information and strategies to grow the game further. (Deloitte)

A somewhat pessimistic take on women’s sport, particularly football in Europe. Despite soaring valuations, revenues and profits are still meek in women’s football on the continent, which puts undue pressure on the game to grow and compete with the men’s sport. (Roger Mitchell on Substack)

The optimist’s take: an interview with Michelle Kang, owner of the Washington Spirit (NWSL), OL Lyonnes and the London City Lionesses (WSL). Out to prove that women’s football can compete with a genuine business model, Kang discards any talk of it being just another corporate DEI project. (Forbes)

Women’s participation in sport is increasing, from the pitch to the boardroom. The NFL now has more women owners than ever before. (FOS)

Sportfive’s annual report on women’s football, showcasing the increasing commercial interest in the game. Clearly, the appetite for investment is there and rising. (Sportfive)

Other pieces of news that interested us:

French actor Omar Sy has become a co-owner of Paris Basketball. Sy, known for his roles in Lupin, the Intouchables, and Jurassic World joins David Kahn and Eric Schwartz at the helm of the team. (L’Equipe)

Wrexham AFC are looking to raise funds at a valuation of $475 million, months after reports of an already eye-watering $100 million came out. The club is now in the EFL Championship, thus being just a season away from the Premier League. (Bloomberg)

French telecom magnate Xavier Niel has joined forces with Iconix to submit a €60 million bid for the iconic French sportswear brand Le Coq Sportif, which is currently in receivership. A month ago, it was revealed that Niel had become the majority shareholder of US Creteil, who are in the fourth tier of French football. (Fashion Network)

Hashtag United, who were founded as an amateur, YouTuber led football team in 2016, have crowdfunded nearly £800,000 for a new ground for the club. The club have started from the bottom to now reach the seventh tier of English football, just three steps away from the professional game. (Hashtag United)

Fanatics’ Paris Saint-Germain collection show a 4,200% increase in sales after the club won the UEFA Champions League. (Globaldata)

The Australian SailGP has been acquired by a consortium led by Hugh Jackman and Ryan Reynolds, just weeks after Anne Hathaway was named among the acquirers of the competition’s Italian entry. The new sport of choice for the ultra-wealthy, the water-motorsport competition is attracting a lot of celebrity capital. (The Straits Times)

That’s all for this week! For more content, follow us on LinkedIn, and if you’re interested in learning more about us, please visit www.sportinvestmentstudio.com

Excellent newsletter !